COVID-19 unlawfully disrupted the global economy and the well-being of the human race. It has created a paradigm shift across every walk of life. The retail industry and a lot of retailers did not have a plan for something as unprecedented and widespread as this pandemic.

Shopping behaviors have changed fundamentally. The spending has nosedived, consumers and retailers are anxious, uncertain and an increasing loss of control snowballing into a reduction in purchases other than the daily essentials.

There has been a phenomenal transformation in the experience of shopping and it has impacted the way retail operates with different technologies, consumer habits, and expectations. shaping the industry, and the way consumers approach shopping is a distinctive contrast to how they did over 10 years ago.

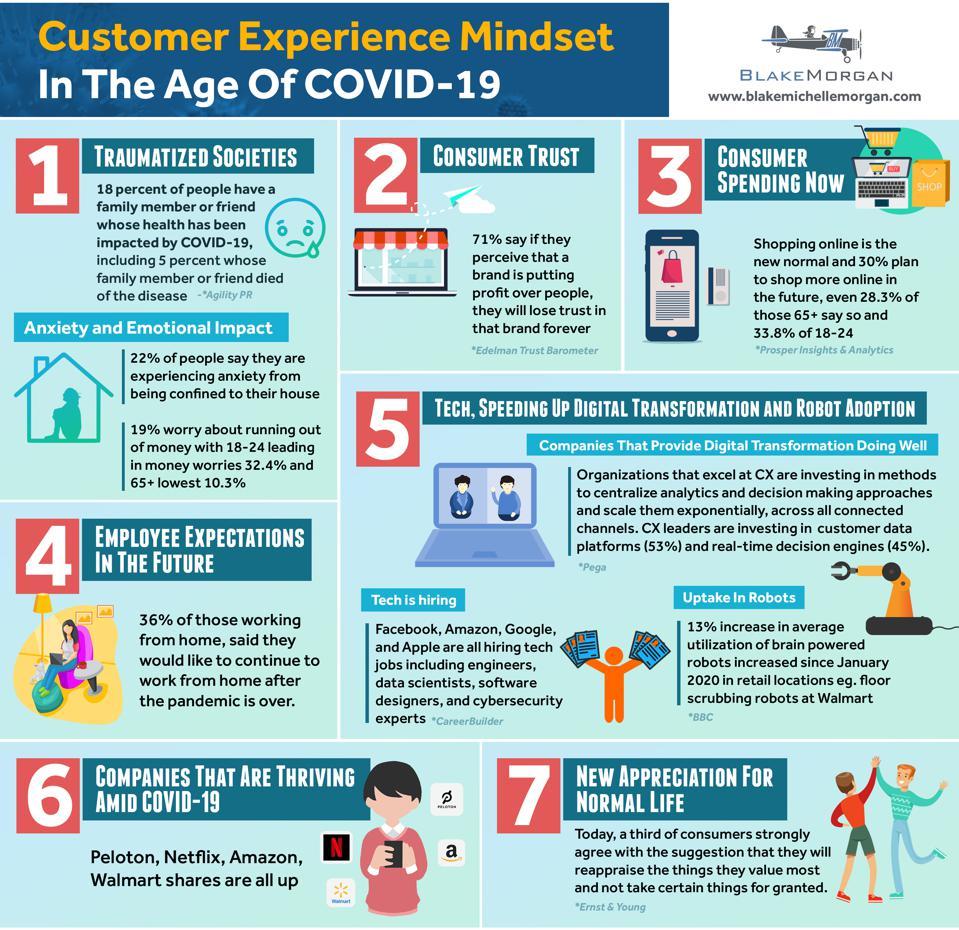

The above statement can be ascertained from the infographic shared below.

Source: Retail Week

Retail In India: –

The retail industry in India has emerged as one of the most dynamic and fast-paced industries due to the entry of several new players. The industry was estimated to be at US$ 435 billion in 2010. 95% of the market was valued at US$ 414 billion which was traditional retail and organized retail accounted for 5% contributing $21 Billion.

Fast forward to 2020 Indian retail sector reached $3600 billion accounting for 10% of India’s GDP and employing approximately 40 million individuals.

The country ranked at 73rd position in the United Nations Conference on Trade and Development’s Business-to-Consumer (B2C) E-commerce Index 2019. It is the world’s fifth-largest global destination in the retail space and ranked at 63 in World Bank’s Ease of Doing Business 2020.

According to the FDI Confidence Index, India ranked 16 (after the US, Canada, Germany, United Kingdom, China, Japan, France, Australia, Switzerland, and Italy).

Market Size: –

Retail industry reached a size of US$ 1.1 trillion growing at an approximate CAGR of 13%. Online retail or E-Commerce reached $60Bn growing at a CAGR of 31%. The country is expected to be the fastest growing digital commerce market across the globe. The impetus to this growth is due to robust investments in the sector and rapidly moving telecom infrastructure contributing to incremental growth in the number of internet users.

E-commerce is revolutionizing the way consumers choose and shop with a myriad of choices at affordable costs. Traditional model of retailing has to pivot to leverage digital retail channels (E-commerce), enabling them to spend less money on fixed costs while penetrating in tier II and tier III cities with a better reach and service to the consumers.

It is estimated that by 2021, traditional retail share will be 75%, organised retail share will reach 18% and E-commerce retail will acquire 7% of the total retail market.

Factors responsible for the Growth of E-tailing in India: –

- Zero fixed asset costs such as land, recurring costs such as monthly rent. E-retailers do not need plush showrooms at prime locations, and instead operate through their digital presence, which significantly saves the overall capital expenditure and recurring costs, in comparison to a physical store.

- E-retailing empowers personalized experience for customers and helps the retailer to sell anywhere globally.

- Seamless shopping experience saving time.

- Since the internet is “Always On”, the ecommerce stores are accessible 24×7 and customers do not have to worry about doorstep delivery of their purchase.

- Since 2005, India has witnessed a rampant growth and development of infrastructure in the telecom space and we are now looking to transition to 5G very soon. It is expected that approximately 40 million users will subscribe to 5G.

- Consumers today have a myriad of options when it comes to online shopping and also for goods that are not available offline.

Evolution of Retail Industry In India: –

The industry has come a long way from being a neighbourhood kirana store in 1990 (Retail 1.0) to becoming a globally tolerant, multi-channel retail market with cross border trade, product diversification and rapid technology advancement into (Retail 3.0).

Specifically as shared above from 2005 onwards the industry has grown by 1.5x – 2.5x every five years, leading to nearly $1.1 trillion in 2020. Let’s have a look at a brief snapshot of the journey

Retail 1.0 (1990 – 1999): –

- The shift was from traditional setup to pureplay modern brand outlets in MBO and EBO formats primarily in the metros.

- The major demand surge was seen in the grocery and apparel showrooms.

- Some of the key growth drivers were – (A)MNCs as lucrative job destinations for urban aspirants (B)Incremental exposure due to satellite television and international travel.

- The retail sector contributed $98Bn to the economy and about 5Mn jobs.

- The key challenges were – High costs and low internet penetration.

Retail 2.0 (2000 – 2006): –

- The focus shifted towards better product assortment and superior customer experience consistently.

- Emergence of hypermarkets, super markets, cash and carry. The expansion plans also shifted from only metro cities to Tier1 cities and towns.

- The categories that emerged as clear winners were – Footwear, Apparel and Food & Grocery.

- Technology solutions were deployed at the backend to modernize the operations.

- The key growth drivers were – (A)Rise in disposable incomes leading to incremental consumer consumption.

- The contribution was $54Bn to the economy and 2Mn. Jobs.

- Some of the major challenges faced were – Supply chain optimization beyond Tier 1 cities and availability of liquidity for expansion.

Retail 3.0 (2007 – 2020): –

- Technology was the key growth driver helping businesses to offer wider product assortments and ease of purchase.

- Key categories that emerged – Consumer Electronics, Lifestyle products, Apparel and Footwear, Food & Grocery.

- The emergence of Marketplaces, D2C brands and omni channels replaced physical retail presence.

- The key growth drivers for this transformation are – (A)Growing consumer trust on digital channels for doing transactions. (B)Rise of Digital Payments. (C)Increase in M-commerce. (D)Gig Economy (E)Vertical specialists as category leaders.

- Major Problems that still persist – Penetration beyond 500 cities yet to evolve. Seamless cross channel collaboration is far from maturity.

- The sector contributed $641Bn and approximately 31Mn. Jobs.

Retail 4.0 and What lies Ahead: –

Retail in the new era will be driven by a new business model of (O+O) – “Offline + Online”. The convergence of retail channels with integration of modern technologies will shape the future of retail in the country.

The traditional channels are yet to adopt optimal digitally smart operations to build focused and purpose led collaborations.

Factors driving this transformation:

- Development of new technologies such as AI, AR, ML.

- Evolving consumer behavior.

- Entry of new players formalizing the value chain, Cost and Operational efficiencies.

- Macro Economic Factors such as demonetization in 2016, GST Reforms, and the current pandemic.

- Maturing Omnichannel.

- Increasing affinity for Ecosystem driven models.

The four key enablers driving the O+O approach are as below

Expected Growth:-

Noticeable Latest Trends in Retail & Shopping Behavior: –

Covid-19 has forced businesses to pivot and also impacted the shopping behaviors of cost conscious economies like India. Some of the radical changes and challenges created due to unlawfully forced disruption are

- Paradigm shift towards online shopping – According to a Mckinsey report by, approximately 96% of consumers have made an introduction to online purchase and E-commerce portals and nearly 60% of them will continue to do so during the festive season also.

- Personalized Shopping Experience – In the 24×7 internet world technology E-commerce businesses are deploying solutions like chatbots, virtual assistants to serve their customers thereby enabling them to engage with the brand on the go.

- Significant adoption of AI – The combination of Big Data intelligence, AI, ML and analytics is helping retailers optimize their inventory and supply chain. AI marketing is another application which the retailers are resorting to attract more engaged and loyal customers.

- Emergence of Shopping Locally – Working from home and fear of contracting the disease has helped the local retailers make money. This trend is likely to continue in 2021 also. There is also a sentiment developing among the shoppers to support local kirana stores so that they can get personalized experiences like credit.

- Decision Intelligence – This is a more refined version of old business intelligence and big data coupled with Machine learning and Artificial Intelligence. To increase profitability retailers are resorting to such technologies to monetize their existing data assets enabling the leaders make decisions enhancing end to end business performance in areas such as Marketing, Merchandising, Supply Chain and Operations.

- Retailers as Platforms – There are quite a few avenues to this. Retailers can create value for their target audience and customers using engagement/loyalty programs, promotional offers, real time offers and pricing, digital ad platforms, and marketplaces. For all such activities customer data must be harnessed to decipher actionable insights.

- Creation Of Digital Ecosystems – Unification of existing digital platforms entailing ecommerce, supply chain, data hubs, ML repository and In-store technology stack into a single, self-learning ecosystem.

- Digitally Enabled Stores – The store of the future will have much greater amount of technology in it – from outdoor displays showing next pick-up times, to dedicated BOPIS lines, to self-checkout and mobile-based scan and go apps. In-store technology like POS will evolve fast with more checkouts being omni-functional (working both with a cashier but also self-checkout) and more stores adopting self-checkout and flexible digital solutions to enable loyalty and the sales of digital products.

- Contactless Experiences – COVID-19 has taught us the basics of hygiene in all walks of life. In the future interactions we can expect stores will use technology to accept contactless payments, Zero Contact supply chains, Seamless checkouts, Scheduling of appointments for pickups etc.

- Optimal Supply chains – There are already many digital solutions in place to create optimal processes right from the manufacturing to the end customer point. They are being made ready for providing a high degree of customer centricity, operational excellence and digital profitability.

High performing supply chains of the future need to be measurable, connected, agile, pre-emptive and continually optimizing and leveraging data as an asset. Key focus areas include demand planning, inventory visibility and optimization across the ecosystem, supply predictability, fulfilment optimization, store operations optimization (picking, dynamic slots, workforce planning), returns optimization among others.

Concluding Remarks: – Change is the only constant and Retail is no exception. The paradigm shift in Retail and what industry 4.0 has to offer that we have observed and discussed above is what we at VendifyTM have figured out with a complete solution. Please contact at sales@vendify.in to know more.